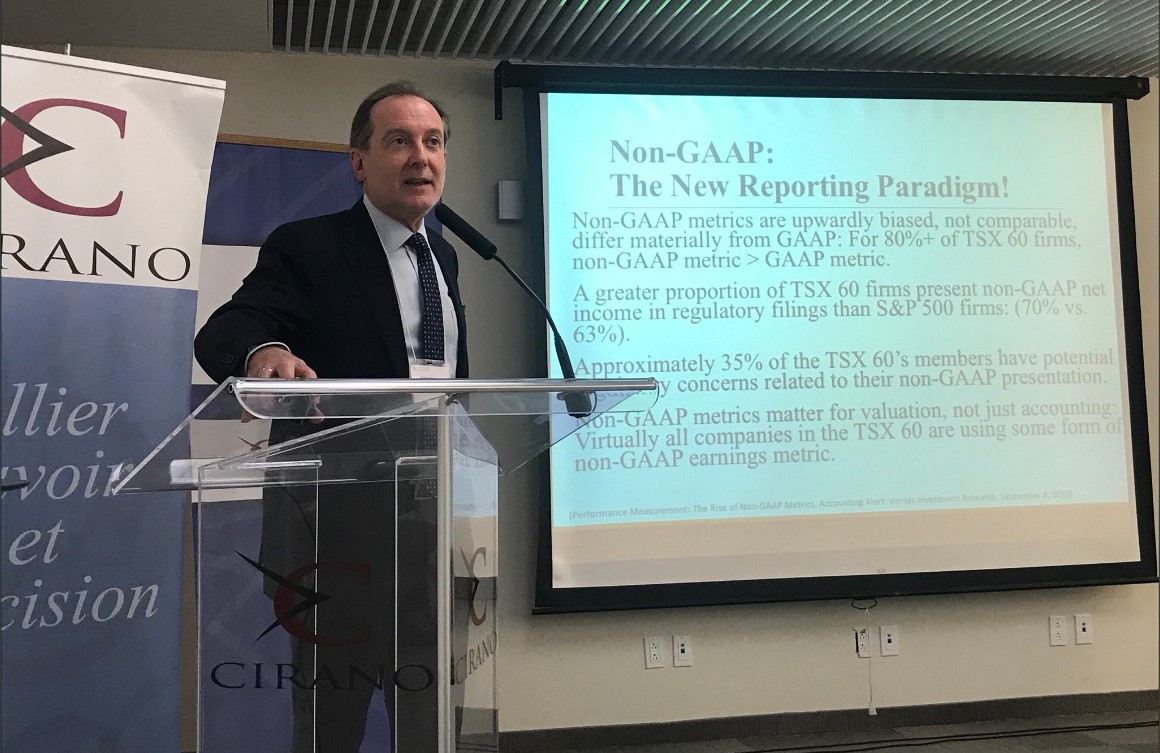

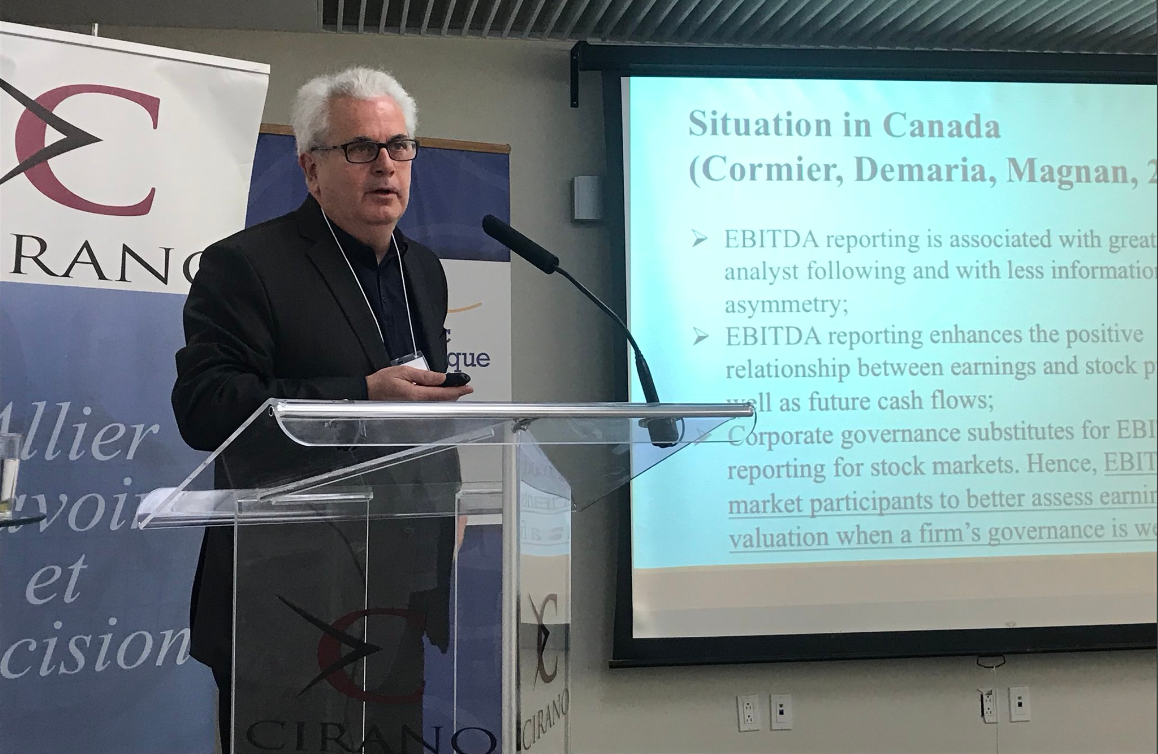

In the context of their investor relations, an increasing number of firms report so-called non-GAAP earnings, i.e., performance numbers which are not consistent with financial reporting standards. Such a practice has recently attracted considerable attention from regulators, investors and various financial markets’ participants such as analysts who must decode such numbers to unveil a firm’s underlying economic reality. Such a state of affairs raises several questions:

- What are the issues raised by the increasing use of non-GAAP reporting by listed entities?

- What are the drivers underlying top management’s increasing reliance on non-GAAP performance measures for their investor relations?

- What are the challenges that arise for analysts and investors from the use of non-GAAP reporting?

- What are the concerns or issues faced by audit committees from mthe simultaneous use of both GAAP and non-GAAP performance measures?

- What are the governance implications from the use of non-GAAP reporting (e.g., executive compensation)?

This CIRANO Seminar addressed these questions. The seminar started with a brief overview of the current academic knowledge on the costs and benefits of using non-GAAP reporting. Then, a panel discussion between experts from various perspectives debated the merits and implications of non-GAAP reporting.